Are you ready to take your business to the next level?

Contact us and we will strive to offer you the most appropriate deal.

Paytring's Payment Dashboard provides a single platform for businesses to manage all their payment processes. Instead of trying to piece together a thousand-piece jigsaw puzzle, the Payment Dashboard provides the final piece to make the overall picture of your transactions seamless, perfect, and easy to understand. With Paytring, you can sit back and admire the smooth flow of your transactions.

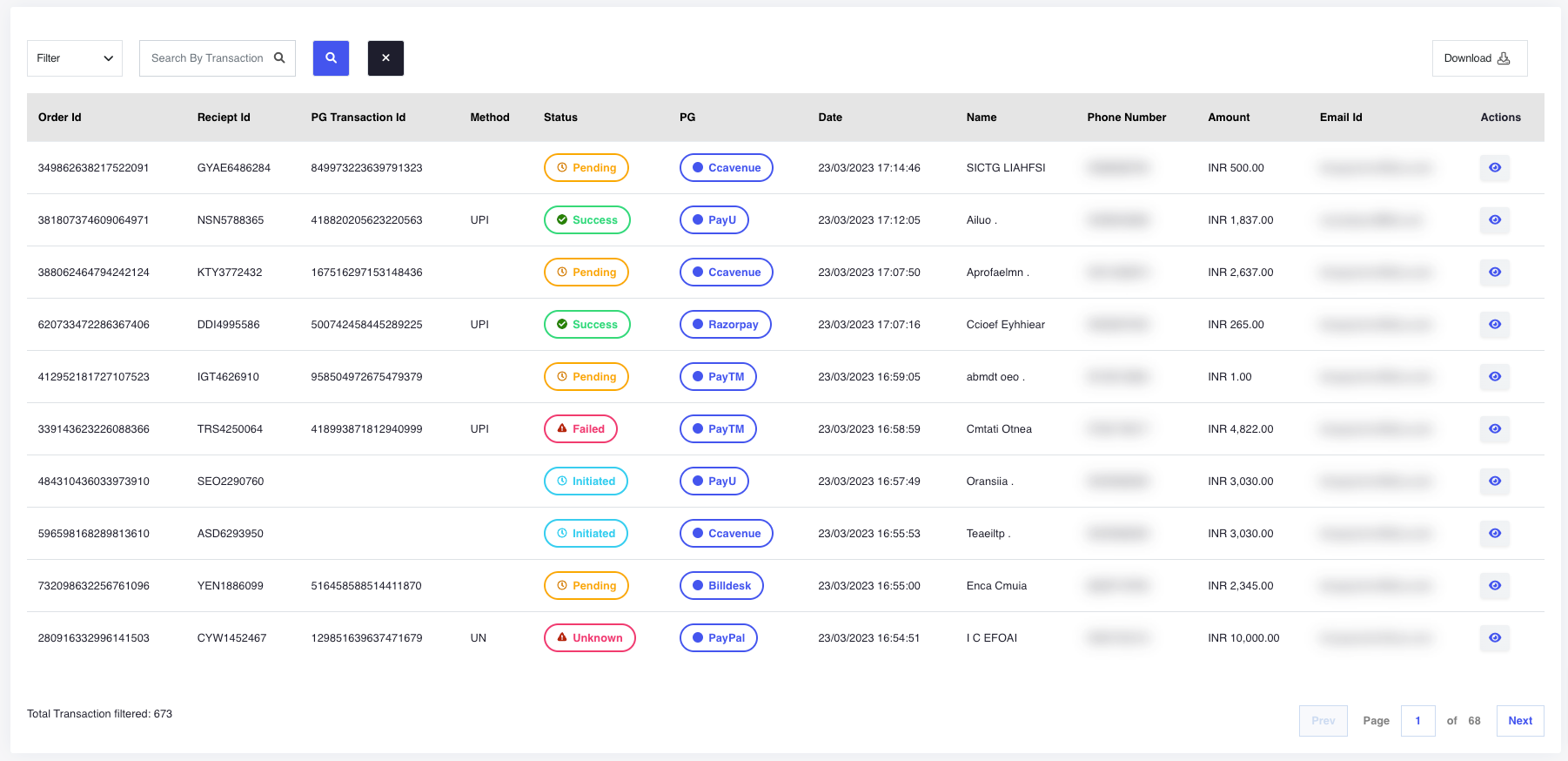

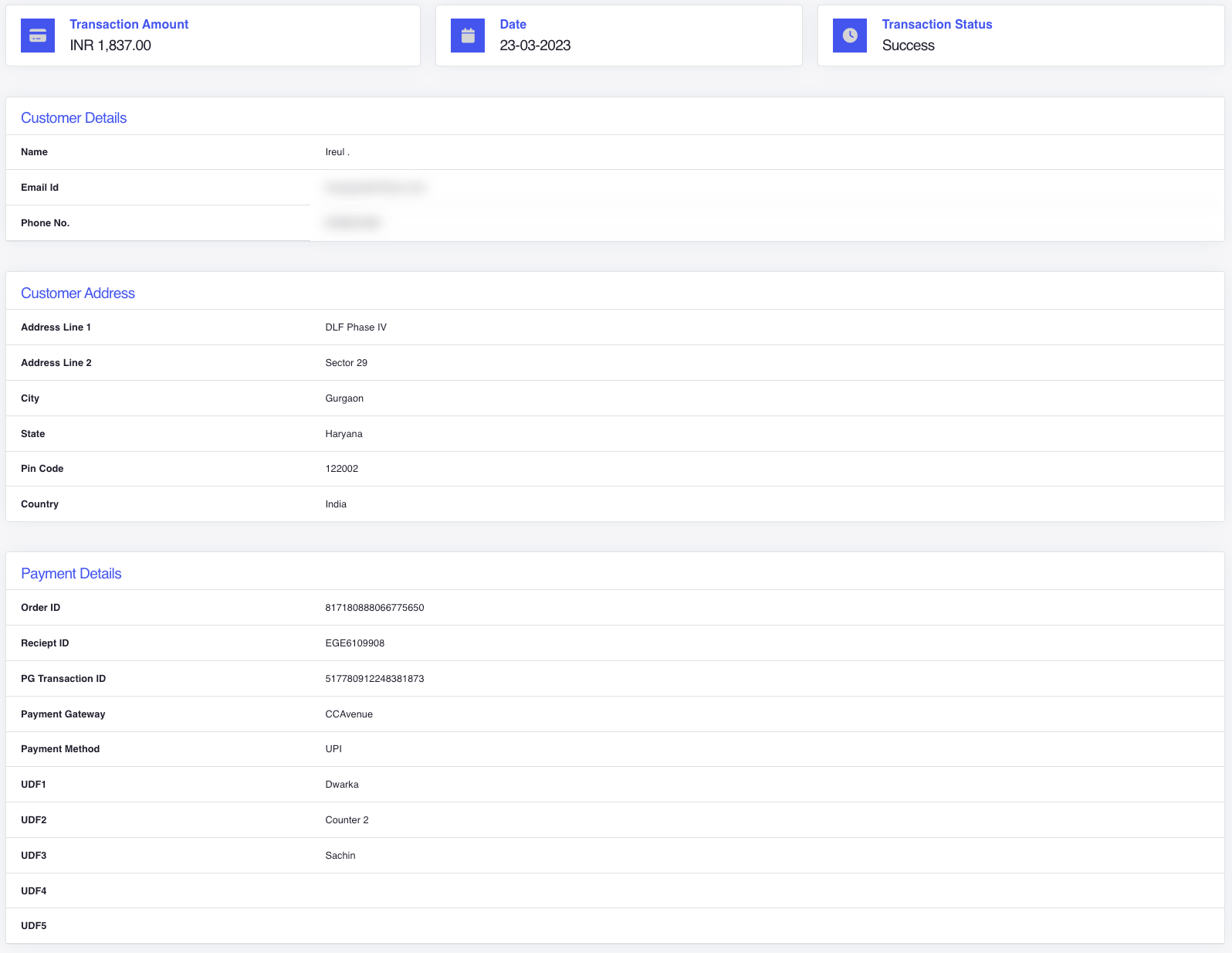

Easily search for specific transactions using their ID or external ID, regardless of their origin. Paytring displays the search results in a user-friendly grid format that is organized into sections. Each result includes important details such as the transaction amount, merchant or deposit account name, status, resolution, date, and time. Clicking on a result will take you directly to the corresponding transaction.

With Paytring's powerful interface, you can manage all your payment processes and configure your account from a single dashboard. This user-friendly interface enables you to view all your data, monitor integrations, manage payments and refunds, respond to disputes, and perform various other tasks with ease.

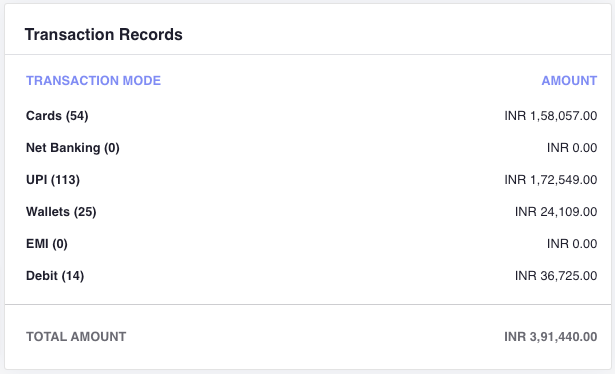

Consolidated business data section in the Dashboard, featuring a wide range of comprehensive features and tools, providing an all-in-one point to view and manage your crucial business data.

By analyzing payment data, businesses can gain insight into customer behavior, including purchasing patterns, preferences, and trends. This information can help businesses tailor their offerings to better meet the needs of their customers.

Payment data analytics can help businesses make better decisions by providing them with the information they need to make informed choices. For example, by analyzing sales data, businesses can determine which products or services are most popular, and adjust their offerings accordingly.

Payment data analytics can help businesses identify areas where they can improve their processes and increase efficiency. For example, by analyzing payment data, businesses can identify and eliminate bottlenecks in their payment processing systems.

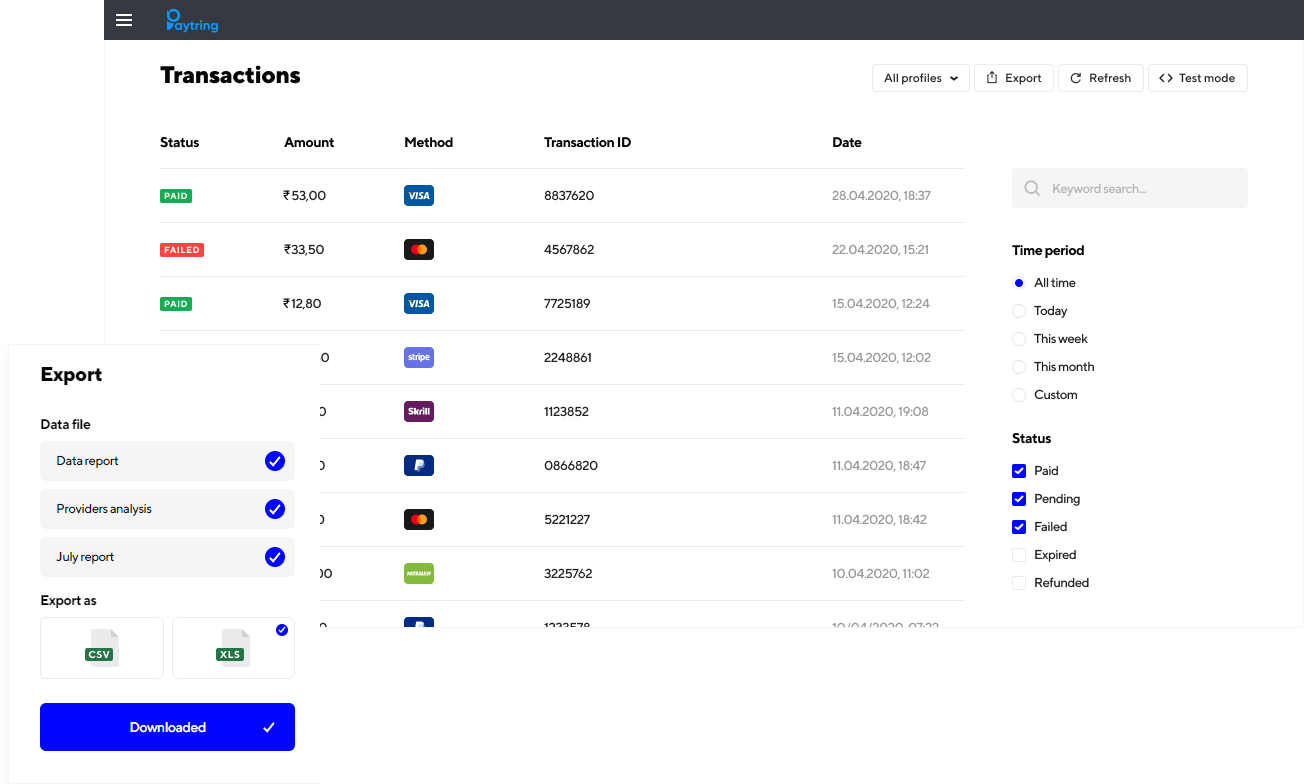

You can filter and export all payment and payout invoices' transactional data in .csv or .xls format through Paytring. Additionally, you can create custom queries to generate highly tailored reports, eliminating the need for external reporting tools.

Ensure that each member of your team can access only the specific data and tools necessary for them to complete their tasks, by either granting or denying access as needed.

If you operate a varied online business with numerous product offerings or multiple storefronts, you can create a customized transaction process for each sub-entity and manage them separately through a single access point.