Manual reconciliations

Our manual payment reconciliation ensures independence from any technical issues that may arise on the provider's side

- API-enabled manual reconciliations. With just one click on the Dashboard, you can request a statement from your provider.

- Manual statement import. You can directly pull a statement from your provider and upload it to Paytring, which can be useful in case of API or callback issues.

- Bulk statement import. Import multiple statements from your provider and reconcile them all at once with ease.

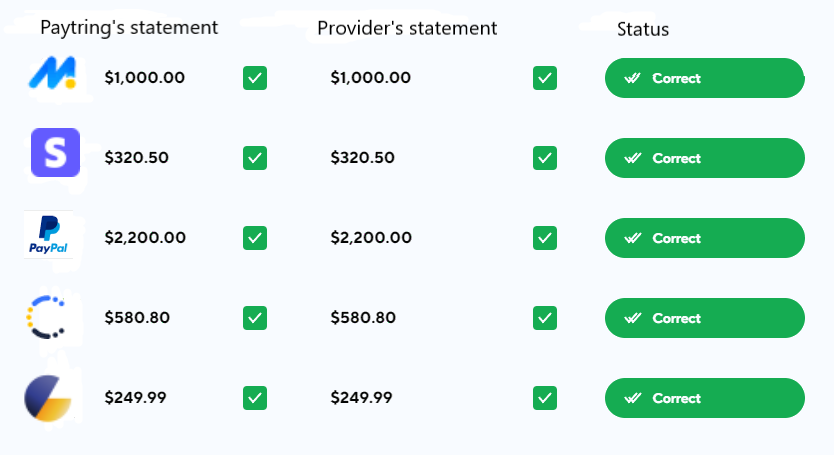

Automated Reconciliations

Automate the error-prone and time-consuming task of reconciling transactions across multiple providers, accounts, and payment methods.

- Streamline transaction processing and automate finalization.

- Delayed auto-reconciliation enables you to identify and record chargebacks or refunds.

- Paytring can handle both callbacks and API responses.

.9fe8fba0.png)